The Carbon Border Adjustment Mechanism (CBAM) represents the European Union’s (EU) commitment to setting a fair price on carbon emissions linked to the production of carbon-intensive goods. Its aim is to encourage cleaner industrial production in non-EU countries.

Understanding CBAM and Its Implications for Importers

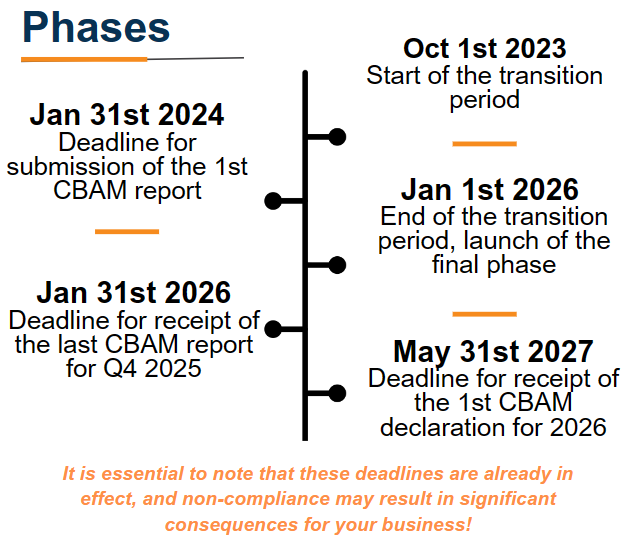

The CBAM will come into force in 2026 and will apply to various products*. Importers will be required to declare each year the verified emissions of imported goods, as well as the carbon price paid abroad.

European importers of goods covered by CBAM will have to register with the relevant national authorities, where they will also be able to acquire CBAM certificates. The price of CBAM certificates will be determined on the basis of the average weekly price of EU Emissions Trading Scheme (EU ETS) allowances sold at auction, expressed in €/tonne of CO2 emitted.

EU importers will have to declare the intrinsic emissions of their imports and surrender the corresponding number of certificates each year. In addition, importers will be able to deduct the corresponding amount if a carbon price has already been paid during the production of the imported goods.

Who Does What? Roles and Responsibilities to Ensure CBAM Compliance

- Importers report emissions and carbon prices for imported goods annually.

- Third country trading partners will provide the necessary data.

- Customs verify the declarations and forward them to the European Commission (EC).

- The EC supervises customs and the competent authorities. It manages the CBAM register, publishes certificate prices, takes account of foreign carbon prices and verifies CBAM declarations.

- The competent authorities in each Member State authorise declarants, sell certificates, accredit verifiers, impose penalties and deal with appeals.

How Eastwise Supports You During the CBAM Transitional Period for Procurement and Supply Chain

- Importer engagement and support: regular communication on CBAM phases.

- Explanation/training/coaching of suppliers: to reduce complexity and share the right information.

- Gathering information from suppliers: to facilitate the declaration process.

- Support in discussions with suppliers. As this measure is likely to have an impact on commercial relations, working with Eastwise can facilitate your commercial exchanges.

CBAM FAQ: Procurement Impact and Importer Compliance

- As a French importer, where do I start?

Start by registering on the transitional CBAM register and raising awareness among your external trading partners. - What finished products does the first phase of this measure concern?

Examples of products: electronic products, furniture and household goods, fence posts and slats, hardware and tools, etc. - What basic information should be collected?

The basic information includes the verified emissions of imported goods and the price of carbon paid abroad. - How should it be collected?

Importers must collect this information from their suppliers and record it in a dedicated file. - Where can I find out more about CBAM?

Visit the European Commission’s CBAM website for detailed information: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_fr#faq - For more details, we invite you to read the dedicated article on Blogistics, a portal committed to providing you with the latest information and best practices in the industry, while offering you educational and technical content.

Do you have any needs or concerns about the CBAM? Get in touch with us!